|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

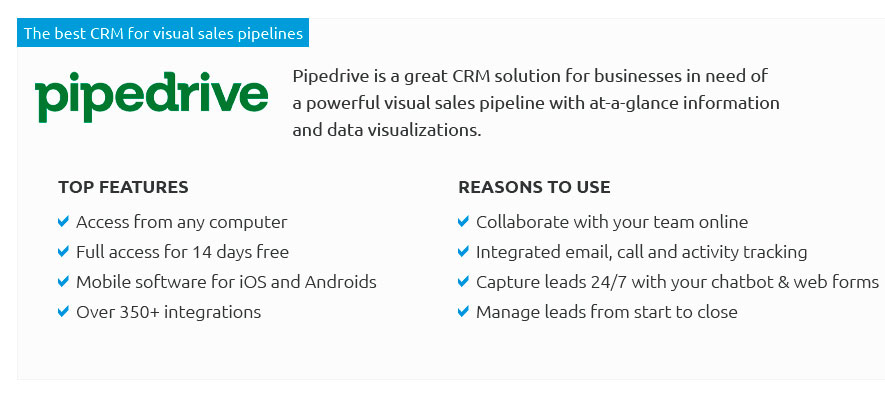

CRM for Health Insurance Agents: Expert Tips and InsightsIn the bustling world of health insurance, agents often find themselves juggling multiple tasks, from managing client relationships to navigating complex policy details. In this context, a robust Customer Relationship Management (CRM) system emerges as an indispensable tool. Health insurance agents can leverage CRM software to streamline operations, enhance customer satisfaction, and ultimately, drive business growth. But what makes a CRM system particularly valuable for health insurance professionals? At its core, a CRM system for health insurance agents is designed to organize customer information, track interactions, and manage leads. Yet, its potential extends far beyond mere data storage. A well-implemented CRM can transform the way agents engage with their clients. By offering a centralized database, it ensures that agents have instant access to critical information, enabling more personalized and timely communication. As agents know, building trust with clients is paramount, and a CRM can significantly enhance this process. One might wonder, 'What features should a health insurance agent look for in a CRM?' To answer this, it's important to consider the unique demands of the insurance industry. Firstly, automation is a game-changer. By automating routine tasks such as follow-ups and policy renewals, agents can free up time to focus on more strategic activities. Furthermore, analytics is another crucial feature. With detailed insights into customer behavior and preferences, agents can tailor their services to better meet client needs, thereby fostering stronger relationships. Integration capabilities should not be overlooked either. A CRM that seamlessly integrates with other tools-such as email marketing platforms and customer support systems-can greatly enhance efficiency. This interconnected approach not only streamlines workflows but also provides a holistic view of customer interactions across various touchpoints. Moreover, security is non-negotiable. Given the sensitive nature of health insurance data, a CRM must adhere to stringent security protocols to protect client information.

Choosing the right CRM can be a daunting task, given the myriad of options available. However, by focusing on features that address the specific challenges faced by health insurance agents, businesses can make informed decisions that align with their strategic goals. Ultimately, the right CRM is not just a tool; it's a partner in success, facilitating deeper client relationships and more efficient operations. In conclusion, for health insurance agents seeking to enhance their operations and client interactions, a CRM system offers unparalleled advantages. By automating tasks, providing valuable insights, and ensuring data security, a CRM empowers agents to deliver superior service and achieve sustainable growth. Embracing this technology is not merely a trend but a strategic imperative in the ever-evolving landscape of health insurance. https://www.wordandbrown.com/NewsPost/best-crm-insurance-brokers

Zoho CRM: Deep feature set, steep learning curve, advanced features only at higher-cost tiers. - Creatio CRM: Best for large sales teams, unified ... https://www.zoho.com/crm/solutions/insurance/

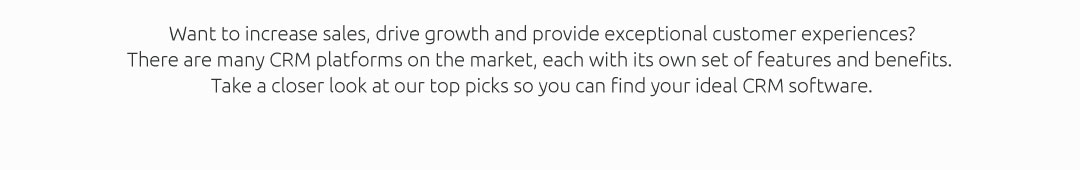

An insurance CRM is a solution that addresses the specific needs of insurance brokers and insurance providers. Organize all your leads and claims. https://www.pipedrive.com/en/industries/insurance-crm

Pipedrive CRM is a great choice for insurance agents as it helps businesses build lean workflows and case resolution processes. Pipedrive's extensive ...

|